Asset Retirements Integrator

The Asset Retirements Integrator can be used to retire or reinstate Fixed Assets via the supported Oracle ERP Cloud REST Web Services. Assets can only be retired or reinstated in the Books that you have access to.

Ensure you are familiar with the More4apps Finance module prerequisites before attempting to use this Integrator.

Please also be familiar with the current Integrator Asset Retirements Limitations. These will be resolved over time as Oracle improves the underlying web services and we add additional functionality to this product.

The following sections are currently available in the Asset Retirements Integrator:

-

Assets

-

Assets (Descriptive details)

-

Retirements

-

Retirement Details

-

Transactions DFFs

-

Retirements DFFs

-

-

Assignments

-

Assignment Retirements

-

-

Reinstatements

-

| For ease of use, customize the sheet layout to focus on either retirements or reinstatements. Having both in the same sheet may lead to confusion. |

Input Method

There are two methods for entering values: direct input on the sheet or via a Data Form. Each method has its own advantages.

-

Direct Input on the Sheet

-

You can manually enter values directly onto the sheet.

-

This method allows you to copy and paste values from a different source.

-

Note that when uploading, a validation process will run to ensure the correctness of all entered values.

-

-

Data Form

-

The Data Form provides an alternative way to enter values.

-

It allows you to search or select values from pre-defined List of Values.

-

This can be useful when you don’t know the exact value to enter on the sheet.

-

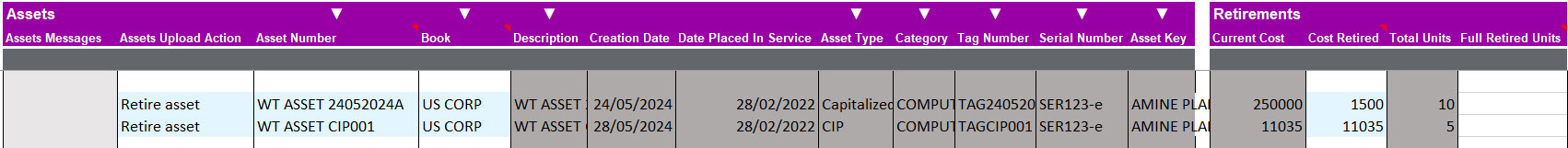

Retire Assets

Assets can be retired in three ways and one of them must have a value.

-

Cost Retired

-

Full Retired Units

-

Partial Retired Units

To retire assets, the 'Current Cost' value of an asset in a Book must be more than 0. To retire by 'Cost Retired' or 'Full Retired Units', make sure the Assets Upload Action is set to 'Retire asset'.

To retire by 'Partial Retired Units', make sure the Assets Upload Action is set to 'Retire asset' and Assignments Upload Action is set to 'Retire asset'. Both upload actions must be entered in order for partial unit retirements to work.

Cost Retired

You must enter the 'Cost Retired' column with either the partial amount or full remaining amount of the asset. Other fields such as the Retirement Details and Descriptive Flexfields can be entered optionally.

Full Retired Units

You must enter the value equal to the 'Total Units' of an asset. A value less than or more than the 'Total Units' will result in an error.

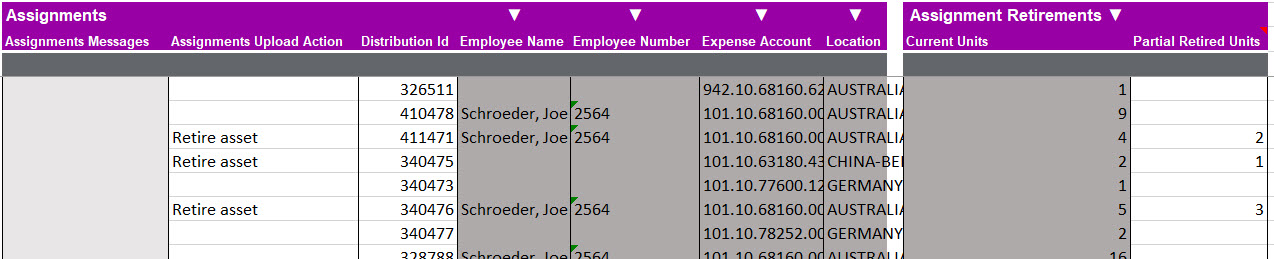

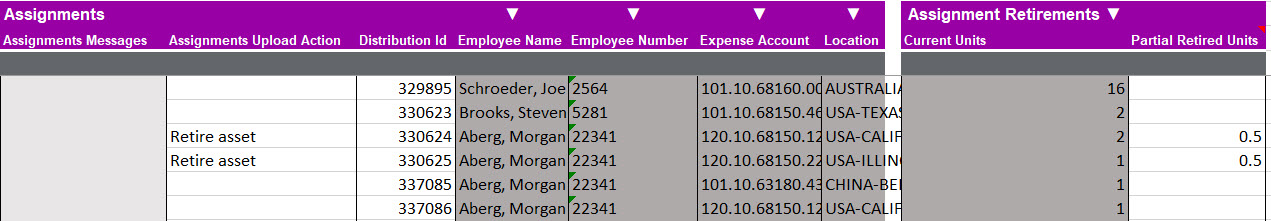

Partial Retired Units

If an asset contains multiple assignment lines, the details of those lines will be downloaded in the Assignments section. Enter a value in the 'Partial Retired Units' column that is either equal or less than the value in the 'Current Units' column of the Assignment line.

Retire Fractional Units

When entering fractional units to retire in the 'Partial Retired Units' column, make sure the sum of the fractional units of all assignment lines retired add up to a whole number. Example below shows how to enter fractional units to retire when there are multiple assignment lines for an asset.

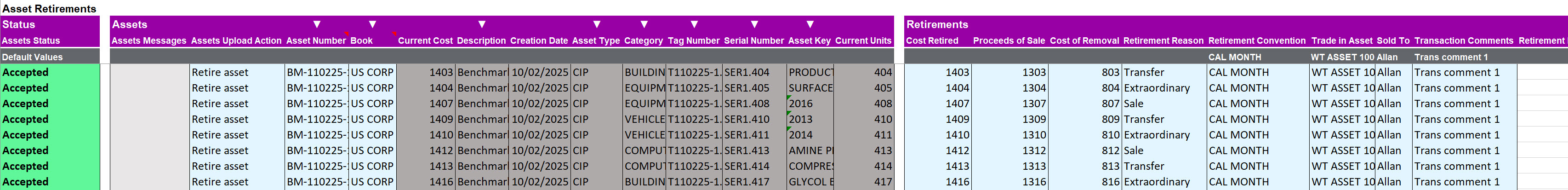

The Assets Status will be returned with 'Accepted' if the retirements are successfully uploaded to Oracle.

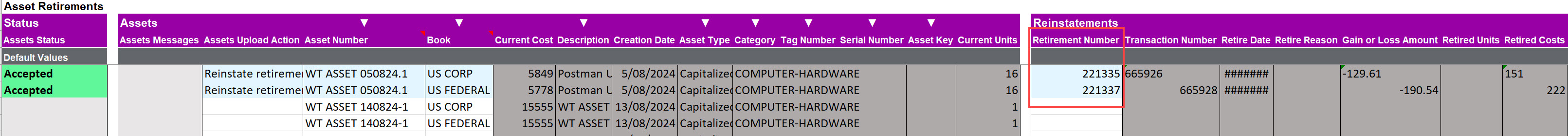

Reinstate Assets

Oracle allows you to correct errors in asset retirements by reinstating them, effectively undoing the retirement process. When reinstating assets that have been partially retired multiple times, only the most recent partial retirement can be undone and reinstated. This means if an asset has undergone several partial retirements, only the last one can be reversed and the asset brought back to its previous state.

To reinstate assets, make sure the Assets Upload Action is set to 'Reinstate retirement' and that there is a retirement number populated against an asset.

The Assets Status will be returned with 'Accepted' if the reinstatements are successfully uploaded to Oracle.