Process Supplier Tax Information

We have implemented several new Tax sections into the Suppliers Integrator. Please see below for further details.

Changes to Integrator Layouts

The position of the following columns has moved from the Suppliers section to the Supplier Tax Registration Header section and the columns have been renamed accordingly:

-

Tax Registration Country: renamed to Supp Tax Registration Country

-

Tax Registration Number: renamed to Supp Tax Registration Num

This section of the integrator now also contains the Supp Tax Registration Type column.

This format reflects the Tax Registration header fields as displayed in the Oracle UI.

The same changes have been made to the Address Tax Registration fields: the new section is called the Address Tax Registration Header.

Overview of Tax Fields

The current version of the Suppliers Integrator includes the following Tax sections at both Supplier and Address levels:

-

Transaction Tax

-

Tax Registration Header

-

Tax Registration

-

Taxpayer Identifier

-

Fiscal Classification

These sections align with the Supplier and Address Tax sections available in the Oracle UI.

Additionally, the following sections are also present:

-

Supplier Tax Profile

-

Address Tax Profile

Each of these Tax Profile sections comprises only 2 columns: Supplier/Address Tax Profile Upload Action and Supp/Address Tax Profile Id. These fields are processed via the partyTaxProfiles webservice, as are the fields under the Supplier/Address Transaction Tax and Supplier/Address Tax Registration Header sections. Therefore, the Upload Action entered into the Supplier/Address Tax Profile Upload Action field controls the processing of the fields in those sections.

Additionally, the Supplier/Address Tax Profile section acts as the parent record for the other Tax sections at Supplier and Address levels, i.e.:

-

Tax Registration

-

Taxpayer Identifier

-

Fiscal Classification

This structure is necessary as the Supp/Address Tax Profile Id is required when uploading data from the above Tax sections.

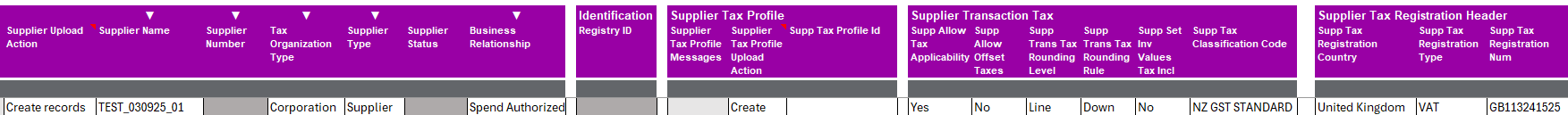

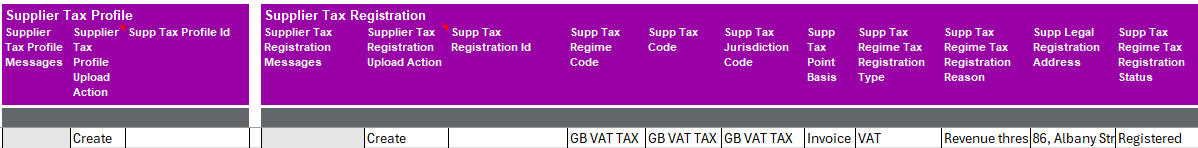

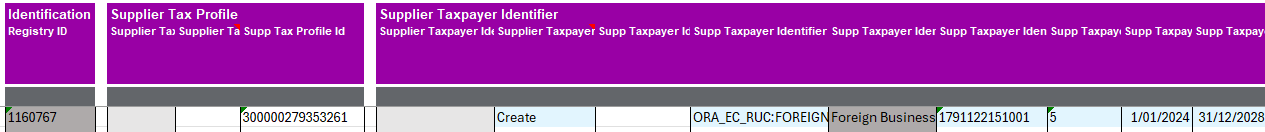

For example, if you are creating a new Supplier at the same time as creating Supplier Tax Registration information, there will be no existing Supp Tax Profile ID for the Supplier. Therefore, you must enter ‘Create’ into the Supplier Tax Profile Upload Action column and the Supplier Tax Registration Upload Action column when creating the record.

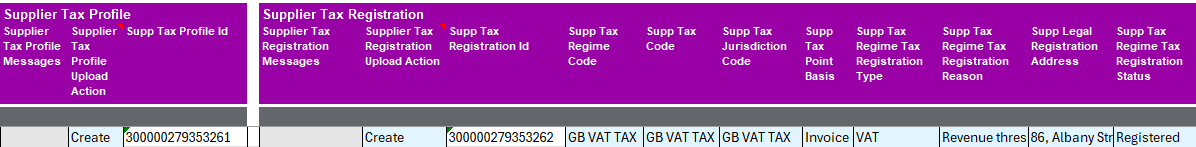

The upload process will create the required Supp Tax Profile ID and the Supp Tax Registration ID:

If the ‘Create’ value is missing from the appropriate Tax Profile Upload Action column during the creation process, you will receive a message similar to the following: ‘Section (Address Taxpayer Identifier) record in row (69) is orphaned. Possible causes include a missing parent record or blank row gap(s) above the current record.’

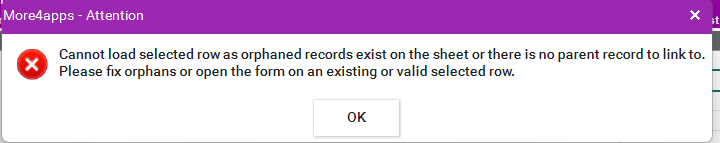

You will also get the following message if you try to open the Data Form for a Tax section when there is no ‘Create’ value in the Supplier Tax Profile Upload Action field:

You can ‘Create’ data in multiple Tax sections with one upload using the above format, i.e. enter ‘Create’/’Create records’ into the Upload Action column for the Supplier Tax Profile section and each Tax subsection.

Once the Supp Tax Profile ID has been created, if you subsequently wish to add Tax data in other sections to the Supplier record or update existing records, download the Supplier into the sheet to populate the Supp Tax Profile ID value and enter the appropriate ‘Upload Action’ into the Tax subsection:

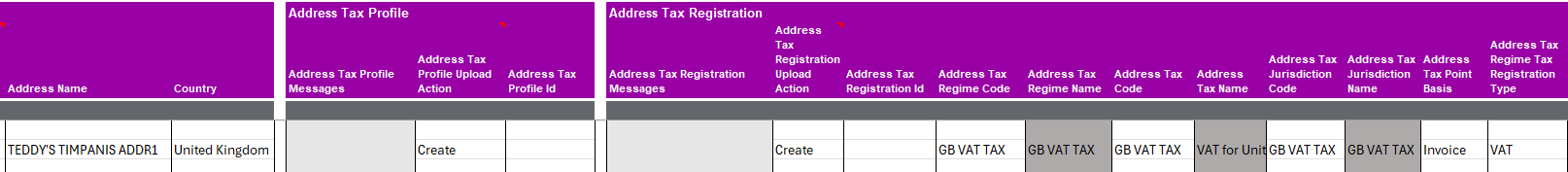

Create / update Address level Tax information in the same way, using the Address Tax Profile Upload Action column instead of the Supplier Tax Profile Upload Action column:

Tax-related ID columns

As discussed above, there are several ID columns in the Suppliers Integrator sheet: we use them to identify records when uploading or updating data. If you would prefer not to see these columns then you can ‘Hide’ them on your sheet.

Do NOT delete ID columns from the sheet or delete the data in these ID columns when processing existing data as the upload will fail.

However, if you are downloading existing records to use as a template when creating new records, all of the IDs must be cleared from the ID columns before creating the new records.

Updatable Tax Fields

Only a limited number of fields can be updated via the Suppliers Integrator: this is in line with the functionality in the Oracle UI. Only those fields which can be updated are included in the ‘Update’ upload via the web service: non-updatable fields are ignored when using the ‘Update’ Upload Action.

The updatable fields in the Tax Sections are as follows:

i. Transaction Tax

All available input fields in this section can be updated

ii. Taxpayer Identifier

The following fields can be updated:

-

Validation Digit

-

End Date

iii. Tax Registration

All fields in this section can be updated except for the following:

-

Tax Regime Code

-

Validation Type

-

Validation Level

-

Duplicate Validation Level

-

Start Date

-

Registration Number

However, please see notes in the 'Issue with 'Set As Default Registration' flag' section below.

iv. Tax Classification

Only the End Date field in this section can be updated.

Issue with 'Set As Default Registration' flag

Please note the following scenario when updating a Tax Registration record which has the ‘Set As Default Registration’ flag set to ‘Yes’.

The three fields which are displayed in the Oracle UI at Tax Registration header level, i.e. Country, Registration Number and Tax Registration Type, may be configured against the Tax Regime Code: the Registration Details section stores the Tax Regime Code and other details, some of which are updateable.

In the Oracle UI, when one of the Registration Details fields is updated and the ‘Set as default registration’ flag for that record is set to ‘Yes’, Oracle will evaluate whether any of the 3 Tax Registration header fields should be updated with the information defined against the saved ‘Tax Regime Code’ record and will make such updates accordingly.

The webservice being used by the Suppliers Integrator to make Updates to Tax Registrations data does not always replicate the behaviour of the UI. From our experience of testing in Oracle Fusion, we have found that if you link the Supplier Tax Registration to a Tax Regime that has “Set as Default Registration = Yes”, Fusion will sometimes null out the Country at the header level even though the Regime is country-specific.

Therefore, before you make updates to your Tax Registrations data, you need to thoroughly test your specific scenarios in a test database. You may consider testing whether uploading the Tax Registrations Details and the Tax Registrations Header in separate ‘Update’ uploads could potentially prevent this issue from occurring but you still need to fully test any process before running any such ‘Update’ uploads.