Adjust Receipts

This functionality enables you to create Receipt Write-offs and Issue Refunds, as per the processes available under the Application > Actions > More menu option in the Oracle UI.

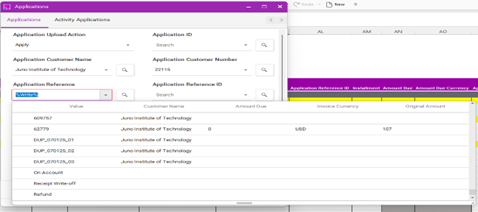

This functionality shares some of the columns in the Applications section and is specifically driven by values available in the Application Reference column – e.g. the ‘Receipt Write-off’ & ’Refund’ values shown below:

The processes for the different ‘Activities’ are as described below.

Refund

| The Integrator is currently unable to Unapply a Refund transaction due to the restrictions of the available webservices. |

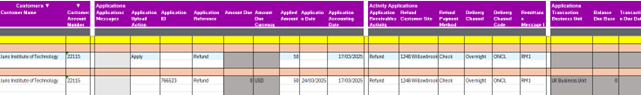

We advise that you create a cut-down sheet for the processing of Refunds as only a limited number of columns in the Applications section are required. The Integrator’s Activity Applications section replicates the ‘Issue Refund’ form in the Oracle UI.

The following screenshots show a suggested format:

Suggested steps to create a Receipt Refund:

-

Download a receipt into the Integrator

-

In the Applications section, select an ‘Action’ of Apply.

-

In the ‘Application Reference’ column, select the value Refund.

-

Enter the Refund amount into the ‘Applied Amount’ column: provide Application and Application Accounting Dates or leave these to default.

-

Select or enter the appropriate Refund Activity in the ‘Application Receivables Activity’ field.

-

Enter appropriate details into the remaining fields in the ‘Activity Applications’ section.

-

Upload the record.

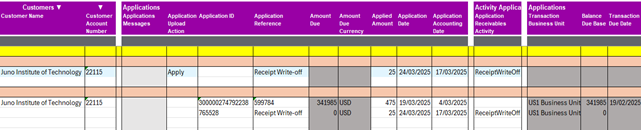

Receipt Write Off

| The Integrator is currently unable to Unapply a Receipt Write Off transaction due to the restrictions of the available web services. |

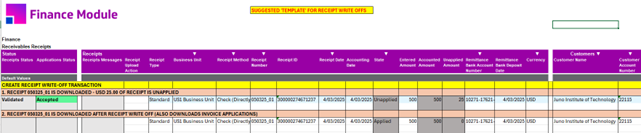

We advise that you create a cut-down sheet for the processing of Receipt Write Offs. The following screenshots show a suggested format for this:

Suggested steps to create a Receipt Write Off:

-

Download receipt into the Integrator

-

In the Applications section, select an ‘Action’ of Apply

-

In the ‘Application Reference’ column, select the value Receipt Write-off

-

Enter the amount to be written off into the ‘Applied Amount’ column

-

Select the appropriate ‘Application Receivables Activity’

-

Enter Application and Application Accounting Dates or leave these blank to default

-

Upload the transaction